If you are going to be living in a unit on your rental property, no rent is being collected on a unit (such as when a unit is used as storage), or you expect the unit to be vacant for the entire year, consider filing an annual exemption from the RSO and/or SCEP fees.

Annual exemptions are valid for the current year only and do not automatically carry over to the next year. The exemptions needs to be applied and the Annual Bill fee adjusted.

To file an annual exemption from the Rent Stabilization Ordinance (RSO) and/or Systematic Code Enforcement Program (SCEP) fees:

New exemption: You can simply access your account at HCIDLABill.org and complete the easy to follow steps. Also, an online video is available to provide further assistance. The Temporary Exemption Application is included with your annual bill each year.

Renew your annual temporary exemptions: Review last year’s exemption(s) on the EC Form mailed to you with your annual bill, make changes if necessary, sign the form, and return in the “EXEMPTION” envelope.

New property owners have 45 days to register rental property and file temporary exemptions using the Registration/Exemption Application Form.

If the status of residency for the previously-exempted unit changes, the property owner must notify the HCIDLA within 10 days and pay the applicable fees.

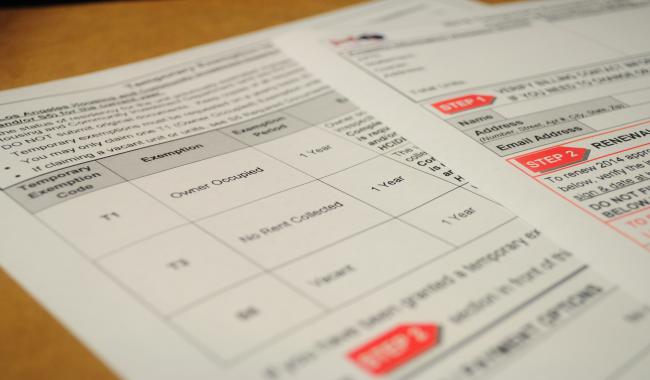

Temporary Exemption Type | Exemption Description |

|---|---|

Owner Occupied (T1) | Owner occupied exemption is limited to only one unit per owner, irrespective of the number of properties owned. |

No Rent Collected (T3) | The unit is occupied but not rented, or is used for non-living purposes, e.g. storage. |

Vacant and Secured (S5) | Unit will be vacant for the entire year and is secured using a deadbolt lock or external commercial-style lock. |

Note: The Vacant (S5) Unit exemption request requires supporting documentation as does the request for 4 or more T3 – No Rent Collected exemptions.

While these exemptions are the most common, there are additional RSO and/or SCEP exemptions.